Top Guidelines Of The Wallace Insurance Agency

Wiki Article

Some Known Incorrect Statements About The Wallace Insurance Agency

Table of ContentsOur The Wallace Insurance Agency StatementsThe Main Principles Of The Wallace Insurance Agency Facts About The Wallace Insurance Agency UncoveredThe Ultimate Guide To The Wallace Insurance AgencyThe Greatest Guide To The Wallace Insurance AgencyAll about The Wallace Insurance AgencySome Known Factual Statements About The Wallace Insurance Agency The 9-Minute Rule for The Wallace Insurance Agency

These plans also provide some security aspect, to aid ensure that your beneficiary receives financial compensation needs to the unfortunate occur during the tenure of the plan. Where should you begin? The most convenient method is to start thinking of your top priorities and requirements in life. Here are some questions to obtain you started: Are you looking for greater hospitalisation coverage? Are you concentrated on your family's wellness? Are you attempting to conserve a great sum for your youngster's education demands? Many people begin off with among these:: Versus a background of rising medical and hospitalisation expenses, you might desire broader, and greater insurance coverage for clinical expenditures.: This is for the times when you're wounded. Ankle joint sprains, back sprains, or if you're knocked down by a rogue e-scooter rider. There are likewise kid-specific plans that cover play area injuries and diseases such as Hand, Foot and Mouth Illness (HFMD).: Whole Life insurance policy covers you for life, or usually up to age 99. https://www.huntingnet.com/forum/members/wallaceagency1.html.

Some Of The Wallace Insurance Agency

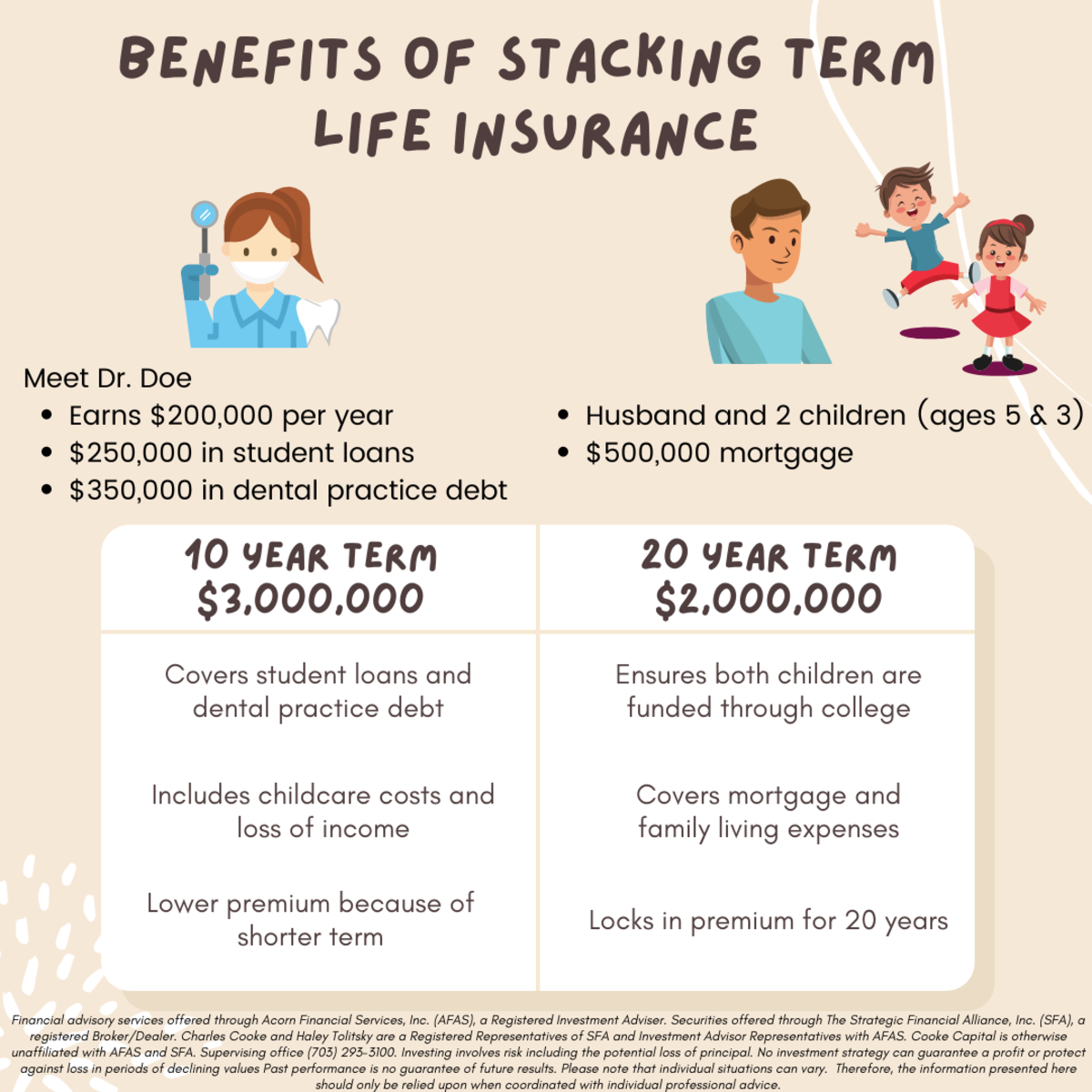

Depending on your protection plan, you obtain a swelling amount pay-out if you are completely disabled or seriously ill, or your loved ones get it if you pass away.: Term insurance coverage gives insurance coverage for a pre-set time period, e - Health insurance. g. 10, 15, 20 years. As a result of the much shorter protection period and the absence of cash value, premiums are generally less than life strategies, and gives yearly money benefits on top of a lump-sum quantity when it develops. It usually includes insurance coverage against Total and Irreversible Special needs, and fatality.

The Best Strategy To Use For The Wallace Insurance Agency

You can choose to time the payment at the age when your kid goes to university.: This offers you with a month-to-month earnings when you retire, normally on top of insurance coverage coverage.: This is a way of conserving for temporary goals or to make your money work harder versus the pressures of rising cost of living.Some Known Details About The Wallace Insurance Agency

While getting various policies will certainly provide you a lot more detailed coverage, being extremely safeguarded isn't a good idea either. To avoid unwanted economic anxiety, contrast the policies that you have against this checklist (Liability insurance). And if you're still uncertain about what you'll require, how much, or the kind of insurance policy to get, consult a monetary consultantInsurance policy is a long-term dedication. Always be sensible when determining on a plan, as switching or terminating a plan prematurely normally does not generate economic benefits.

6 Easy Facts About The Wallace Insurance Agency Described

The ideal component is, it's fuss-free we automatically work out your cash moves and supply cash pointers. This post is indicated for info just and ought to not be trusted as monetary recommendations. Before making any type of decision to purchase, market or hold any investment or insurance coverage product, you should consult from a financial consultant regarding its suitability.Spend only if you comprehend and can monitor your investment. Diversify your investments and avoid spending a big portion of your cash in a single item issuer.

The Only Guide for The Wallace Insurance Agency

Simply like home and auto insurance policy, life insurance coverage is essential to you and your household's monetary protection. To help, let's explore life insurance in much more information, exactly how it functions, what value it may supply to you, and just how Bank Midwest can assist you find the best plan.

It will certainly aid your family pay off debt, receive income, and get to major financial goals (like college tuition) in the occasion you're not below. A life insurance coverage plan is essential to planning these monetary factors to consider. In exchange for paying a regular monthly premium, you can get a set amount of insurance coverage.

How The Wallace Insurance Agency can Save You Time, Stress, and Money.

Life insurance policy is appropriate for nearly everyone, also if you're young. People in their 20s, 30s and also 40s often forget life insurance policy - https://www.provenexpert.com/the-wallace-insurance-agency/. For one, it requires resolving an unpleasant question. Lots of more youthful people additionally believe a plan simply isn't ideal for them given their age and family members situations. Opening a policy when you're young and healthy and balanced might be a clever option.The more time it takes to open a policy, the more danger you encounter that an unanticipated occasion could leave your family without insurance coverage or monetary news assistance. Depending upon where you're at in your life, it is necessary to recognize specifically which kind of life insurance is best for you or if you need any in all.

Indicators on The Wallace Insurance Agency You Need To Know

A home owner with 25 years remaining on their home loan may take out a plan of the same length. Or let's state you're 30 and plan to have children quickly. Because case, signing up for a 30-year plan would certainly secure in your costs for the following thirty years.

Report this wiki page